Simple Bankruptcy Prediction

For decades, researchers have used publicly available accounting ratios to predict corporate bankruptcies.

The corporate bankruptcy prediction is so familiar and ubiquitous that we have missed a fundamental question: why should financial ratios be able to predict corporate bankruptcy better than simple functions of stock market?

After all, corporate bankruptcies are catastrophic for stock prices. Corporate bankruptcy is akin to predicting a stock price. If the stock market is mostly efficient, then publicly available accounting ratios should already be incorporated in stock price information.

Put differently, market evidence should be just as good at predicting corporate bankruptcy without accounting ratios, regardless of the complexity modeled using publicly available information.

Here, I examine four basic facts from simple market evidence: (1) stock market capitalization, (2) stock price, (3) prior one-year stock returns, and (4) market leverage.

Each of these on its own achieves far better predictive performance than the Altman (1968) Z-score in this sample.

Prior one-year return and market leverage perform much better than the Altman Z-Score and as well as complex models, suggesting that more complex models using accounting information generate noise around informative market evidence.

That is, the complexity offered by existing models of corporate bankruptcy prediction was unnecessarily complex. The results presented in Bharath and Shumway (2008), which incorporate Merton’s more complicated model, distance-to-default, perform no better than a simple weighting of prior one-year return and market leverage.

Data

I obtain annual data starting December 31, 2005 and ending December 31, 2022 for the union of firms in the Russell 3000 and Russell Microcap indexes from Bloomberg Terminal. I obtain stock market capitalization, total debt face (for use in market leverage), stock price, past one-year returns, and, where available, Altman Z-scores. The resulting sample contains 41,759 firm-years. I obtain bankruptcy filings and dates from Bloomberg's bankruptcy filing database (BCY), the UCLA-LoPucki database, and Edgar. There are 346 firm-years with a bankruptcy within one year for the set of 41,759 firm-years, an incidence for bankruptcy of about 0.83%. Figure 1 presents the number of bankruptcies by year.

Basic Facts: Stock Market Capitalization, Stock Prices, Stock Returns, and Market Leverage

Stock Market Capitalization

Corporate bankruptcy usually results in worthless stock values. In an efficient market, stock values will incorporate the probability of such catastrophic outcomes.

Consider stock market capitalization. The more likely it is that the stock will be worthless, the smaller the stock market capitalization will be.

Figure 2 plots cumulative bankruptcy filings within one year of a given stock market capitalization. Firms are shown with stock market capitalizations less than about $26.5 billion (natural log = 24), since there are only two bankruptcy filings above that level. The incidence of bankruptcy filings within one year strongly increases as size falls.

Stock Price

Figure 3 plots cumulative bankruptcy filings within one year against stock price. Stock prices are shown through $100, since there is just one bankruptcy filing occurring within one year after that year-end price level. The incidence of bankruptcy filings within one year increases exponentially as stock price falls toward zero.

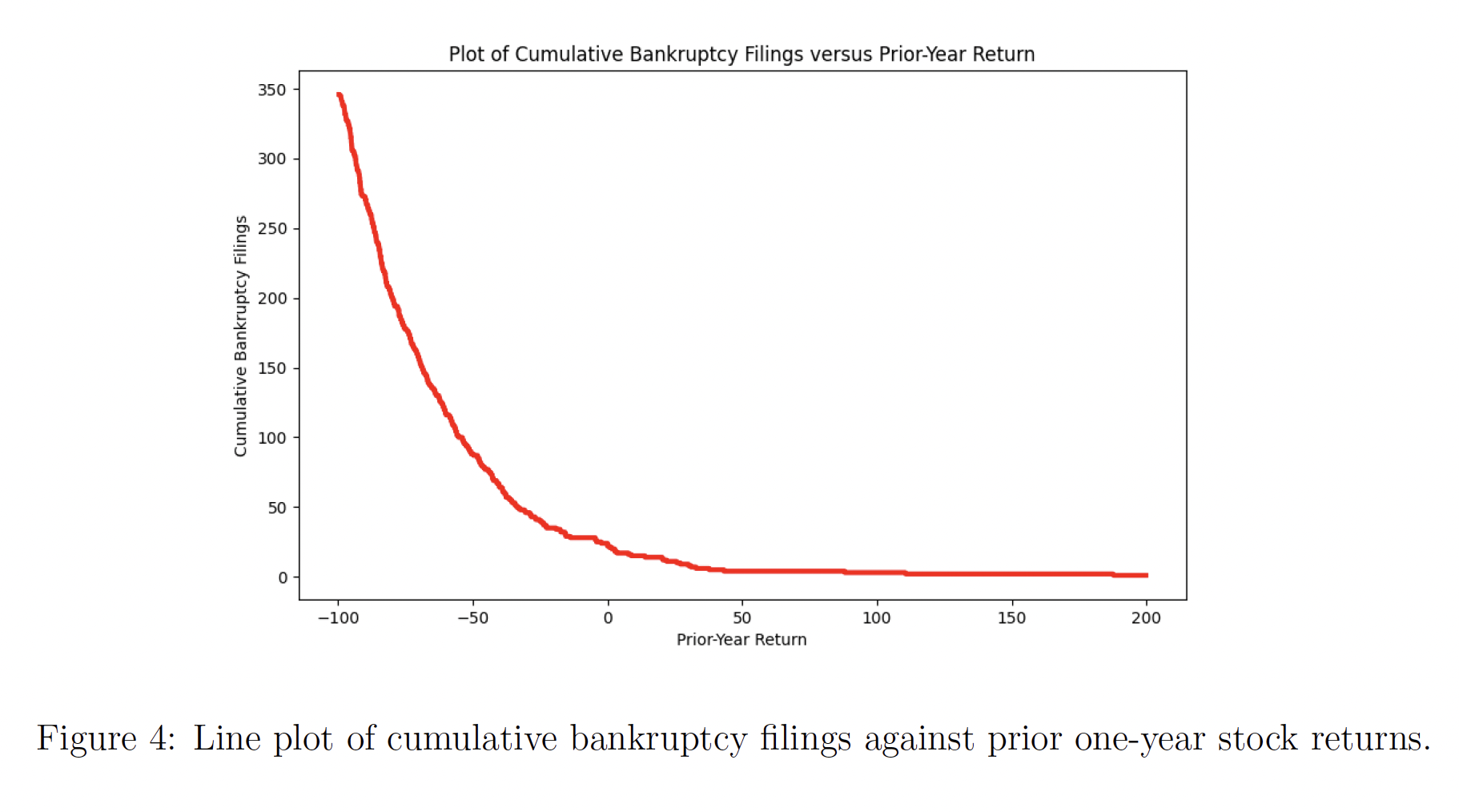

Prior Returns

Figure 4 plots cumulative bankruptcy filings within one year of a given prior one-year stock return. Positive returns are shown through +200%, since there is just one bankruptcy occurring above that magnitude.

When traders determine that stock values are more likely to become worthless, prior returns will become worse. The incidence of bankruptcy filings within one year increases exponentially as the prior year's returns become more negative.

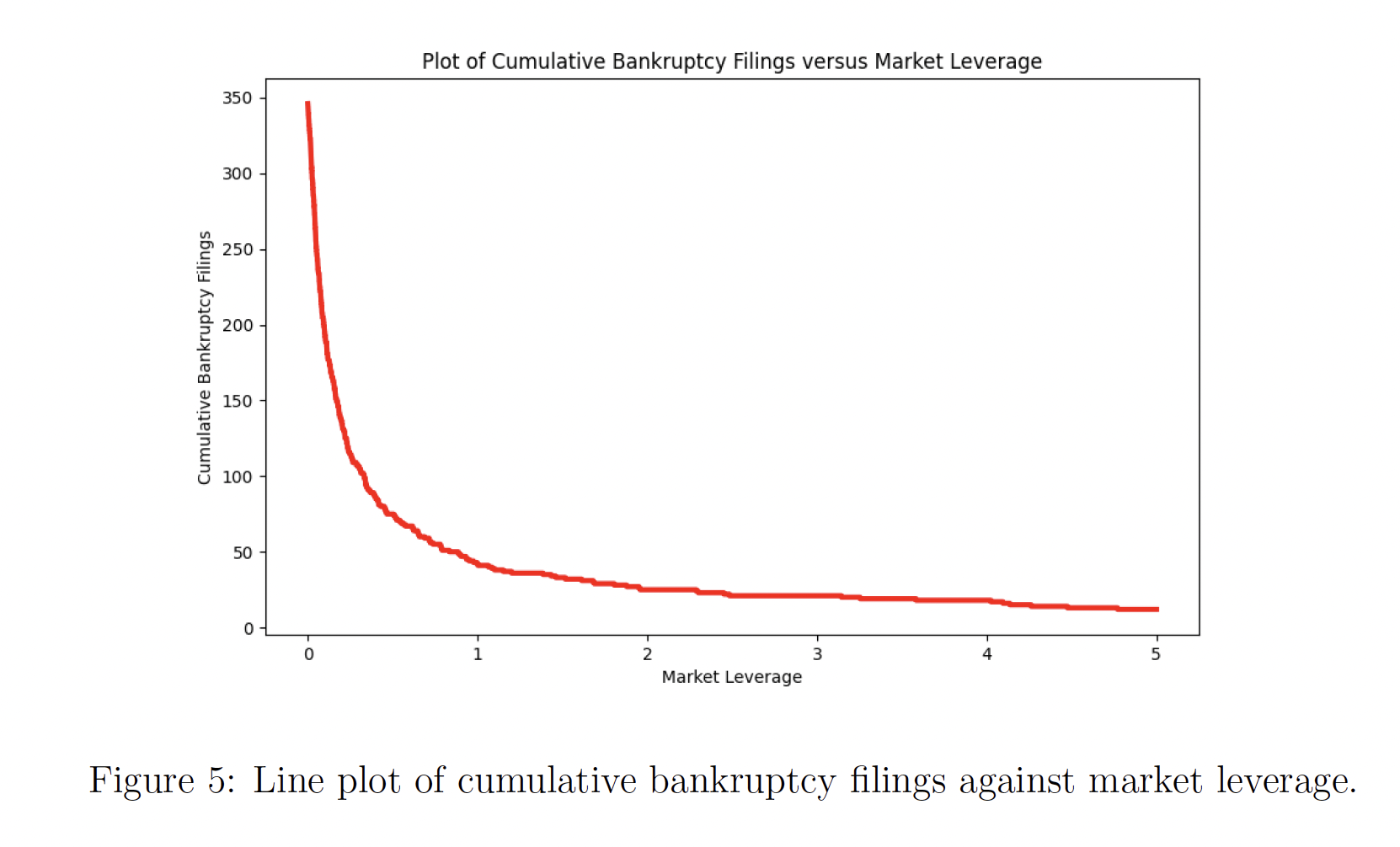

Market Leverage

Figure 5 plots cumulative bankruptcy filings within one year of a given market leverage. Market leverage is the ratio of stock market capitalization to debt face value.

The stock market capitalization is well-characterized as a call option that is in the money when the assets are worth more than the debt.

When the stock market capitalization is likely to be out of the money, it converges toward zero. So, the more likely it is that the call option will be out-of-the-money, the smaller is the market leverage. Firms are shown with market leverage less than 5, since only eight bankruptcy filings above that level. The incidence of bankruptcy filings within one year increases exponentially as stock market capitalization falls as the ratio of debt face value.

Additional Analysis

This paper presents additional information on the use of simple bankruptcy prediction based on market evidence. I show how to use simple thresholds using the F1-score to balance precision and recall.

I also show that Altman Z-scores are poor predictors of bankruptcy compared to simple market evidence.

The poor relative performance of the Altman Z-score is in spite of the fact that it uses market leverage as one of its five ratios. Altman's (1968) additional financial ratios—working capital/total assets, retained earnings/total assets, earnings before interest and taxes/total assets, and sales/total assets—appear to introduce noise. that reduces the predictive power of that market variable in the Altman model.

Overall, prior one-year return and market leverage are the two most powerful individual features. There are good reasons why these two market observables are powerful when combined. Financial firms (including banks and insurers) tend to have high market leverage even when healthy, since their debts (liabilities) are high relative to their stock market capitalization. Very poor past returns can discriminate between firms with high market leverage that are relatively healthy and those that are relatively unhealthy, without eliminating financial firms from the population. Similarly, some firms with very poor returns--often biotechnology and other technology firms--use very little debt and so have low market leverage and a resulting low bankruptcy risk.